VF Corporation, with well known brands in its stable like The North Face®, Vans®, Timberland®, Wrangler®, Lee® and Nautica® , is a global leader in the design, manufacture, marketing and distribution of branded lifestyle apparel, footwear and accessories. The company’s highly diversified portfolio of 30 powerful brands spans numerous geographies, product categories, consumer demographics and sales channels. Denim and Jeanswear is one of the key segments where VF brands have a powerful presence. A study of VF’s financials gives an idea of the direction company is taking and some idea on how consumers are reacting to various segment offerings.

In this report we have done the detailed analysis as well as comparative analysis for 1st quarter of 2017 and a comparative analysis for the same period of last year.

|

Segment |

Q1| 2017 ( Million $ ) |

Q1| 2016 ( Million $ ) |

% |

|

Outdoor & Action Sports |

1678.8 |

1639.1 |

2 |

|

Jeanswear |

647.4 |

710.6 |

-9 |

|

Imagewear |

135.0 |

141.8 |

-5 |

|

Sportswear |

98.3 |

118.4 |

-17 |

|

Other |

22.1 |

24.5 |

-10 |

|

TOTAL |

2581.7 |

2634.4 |

-2 |

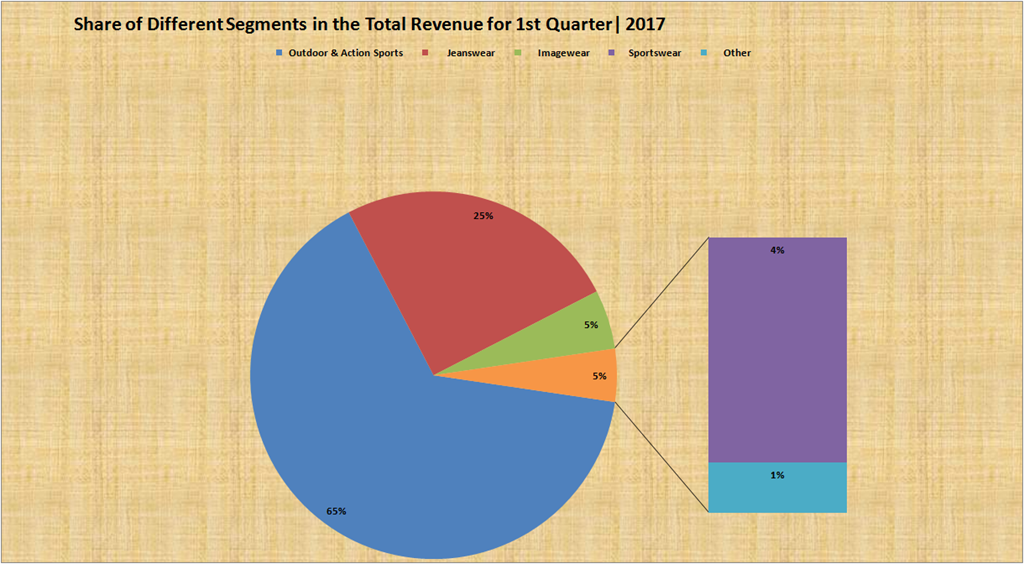

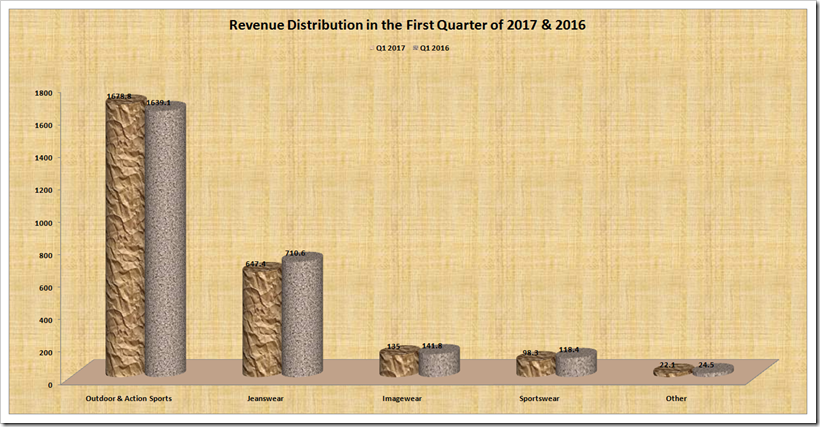

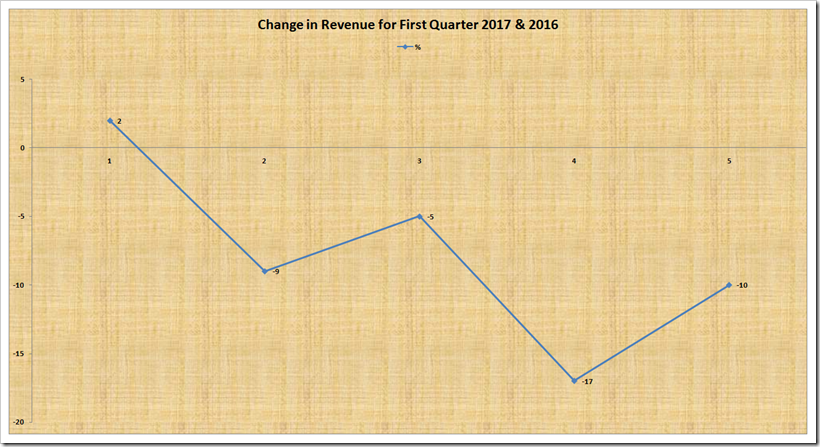

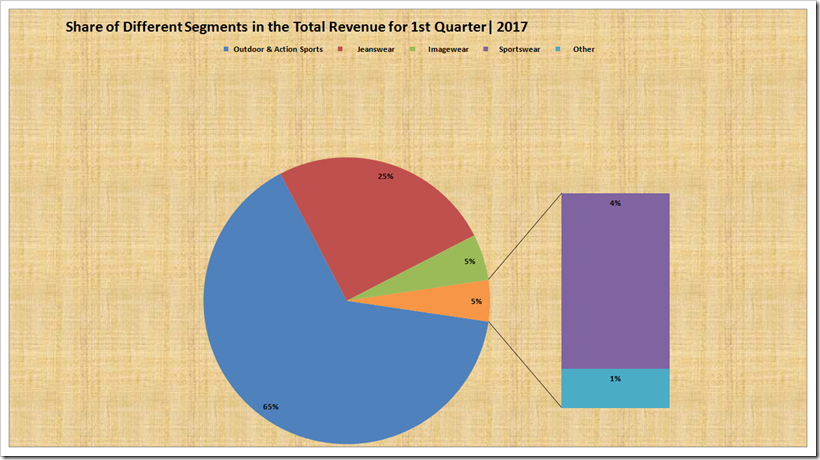

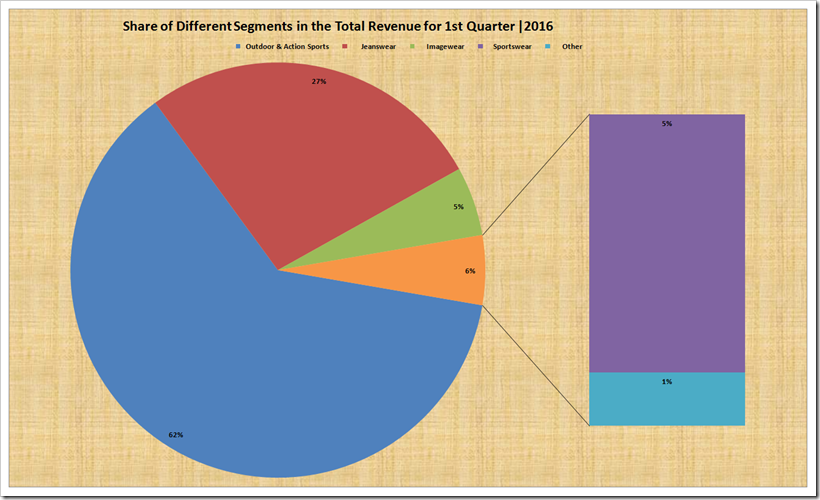

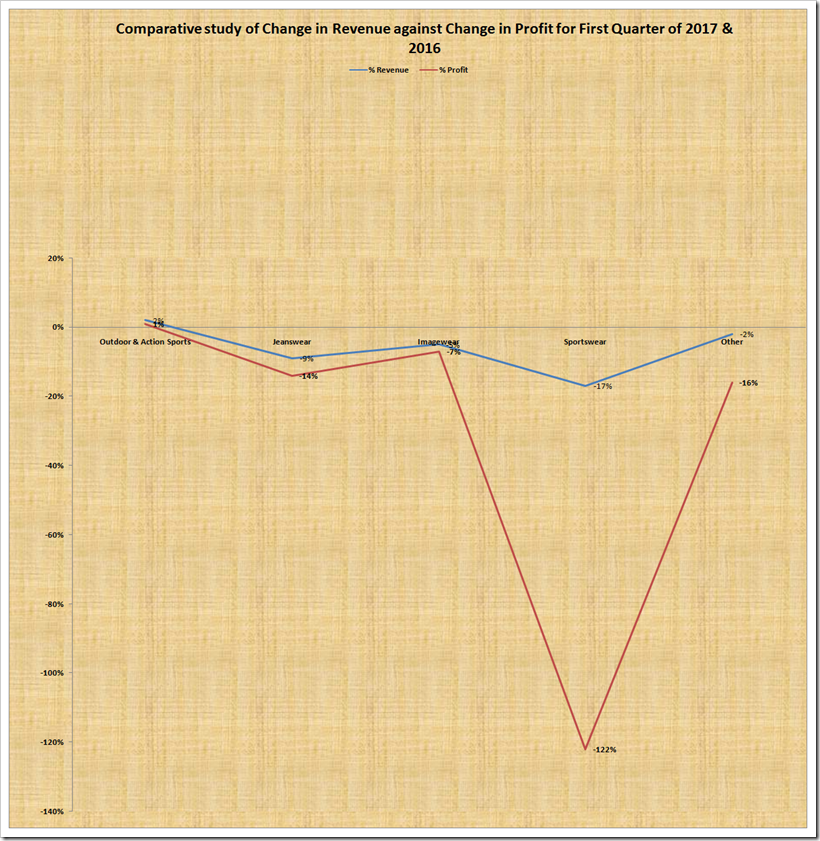

In the 1st Quarter of 2017, VF Corporation’s total revenue is $2581.7 million, out of which outdoor & Action Sports was $1678.8 million which is 65 %(approx) share of total revenue. The sales in Jeanswear has fallen by 9% while Imagewear fell about 5% which is not a normal reduction and shows significant loss of market. There is a huge fall of 17 % in Sportswear sales compared to last year and the other segment also saw a fall of 2 %. On analysis we can find that Outdoor & Action Sports is the current flavor of the consumers and VF, like many other brands, are trying to are struggling to sustain their denim and sportswear sales.

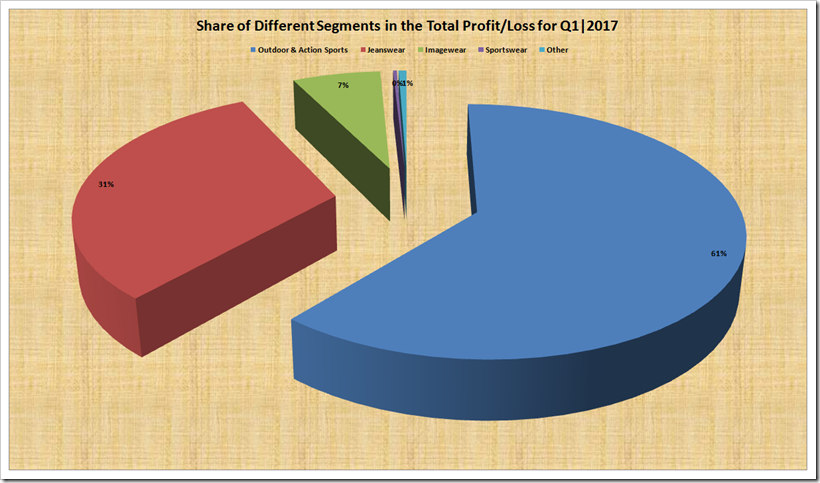

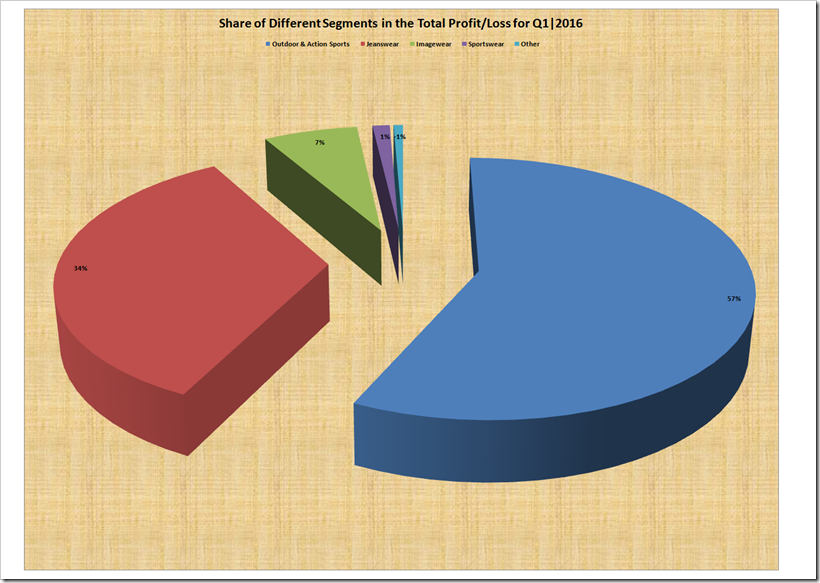

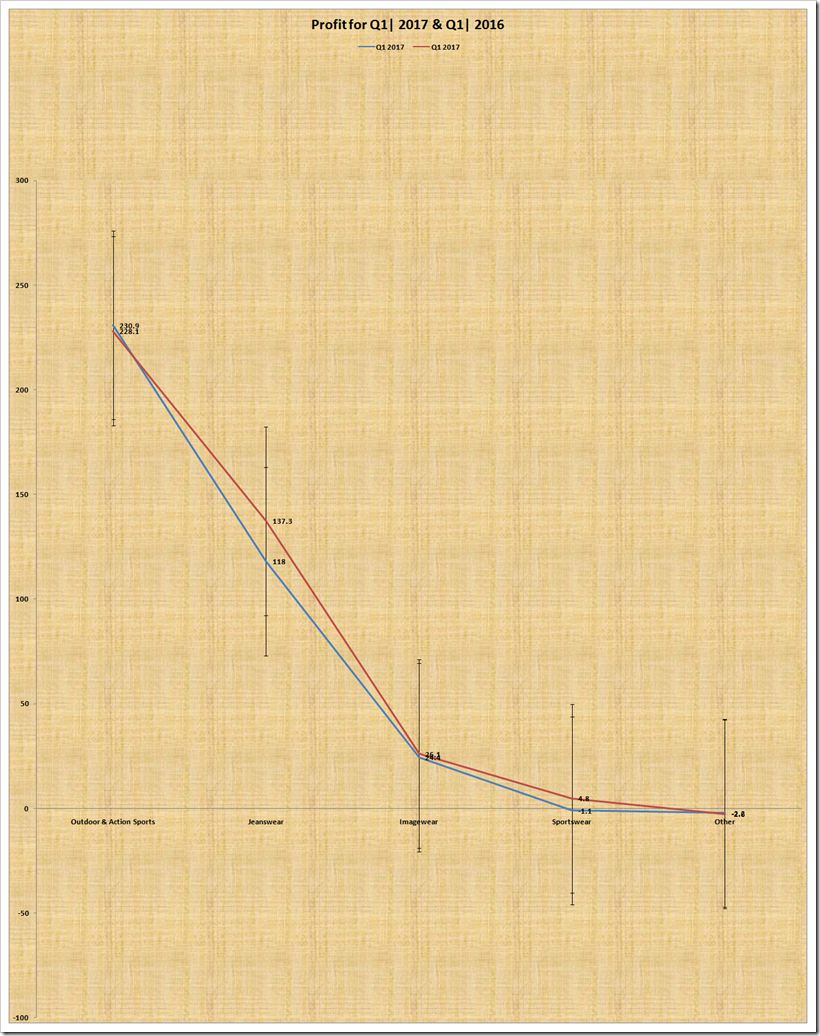

If we look at the profit sharing of different segments ,there is marginal increase in the Outdoor & Action Sports by 1 % from the Q1 of last year ,however the Jeanswear segment reduced substantially by 14% which shows that the actual realisations per unit of jeanswear is lower than last year . There is a fall of 7 percent in the share of total revenue of Imagewear segment. . The Sportswear segment is now a loss making proposition for VF and the company has not made any money on Sportswear sales.

|

PARTICULARS |

Q1|2017 |

Q1|2016 |

% |

|

Outdoor & Action Sports |

230.94 |

228.11 |

1 |

|

Jeanswear |

118.11 |

137.29 |

-14 |

|

Imagewear |

24.40 |

26.14 |

-7 |

|

Sportswear |

-1.07 |

4.78 |

-122 |

|

Other |

-2.20 |

-2.61 |

-16 |

|

TOTAL |

370.10 |

393.71 |

-6 |

|

Particulars |

% Revenue |

% Profit |

|

Outdoor & Action Sports |

2% |

1% |

|

Jeanswear |

-9% |

-14% |

|

Imagewear |

-5% |

-7% |

|

Sportswear |

-17% |

-122% |

|

Other |

-2% |

-16% |

To summarise , Outdoor and Action Sports is the only segment working for VF right now and it seems to find itself in a spot in most other segments. It needs to pull up its socks to keep up in the tough business conditions !