As the cotton market faces high demands and exhausting stocks, India has witnessed an upsurge in cotton prices. Furthermore, an increased import duty of 10% was levied on cotton. In July, cotton prices saw a rise of ₹3,800 per candy in 15 days only. This abrupt soar in cotton prices has sabotaged not only the textile industry and foundation set by Indian exporters.

This year cotton prices were rising since January but last month marked a further increase in prices from ₹51,000 to ₹54,800 per candy of 355 kg as per the Cotton Corporation of India. Additionally, the US, the largest exporter of cotton in the world, slipped down as the state of Texas faced a severe drought last year, thus causing cotton prices in India to firm up since December 2020. There is a shortfall of extra-long staple (ELS) and non-ELS contamination-free sustainable cotton due to the imposition of import duty, as India hardly produces these types of cotton.

The issue of the Chinese Xinjiang cotton ban has changed the cotton trade dynamics. Xingjiang produces over 85% of Chinese cotton and the ban by the US and others ensured that the retailers rushed to source cotton from other sources – a large part of it from India. This helped cotton fiber exporters reap profits, while the industry suffered the shortage and increased prices . Coming on the top of Covid impact, this was a double whammy!

Effect On Denim Costing & Pricing

Denim is primarily a cotton product and any rise and fall in its prices immediately affect the denim costings. The costings have increased tremendously due to cotton even if we ignore the increase in prices of dyes, chemicals, freight, and other costs.

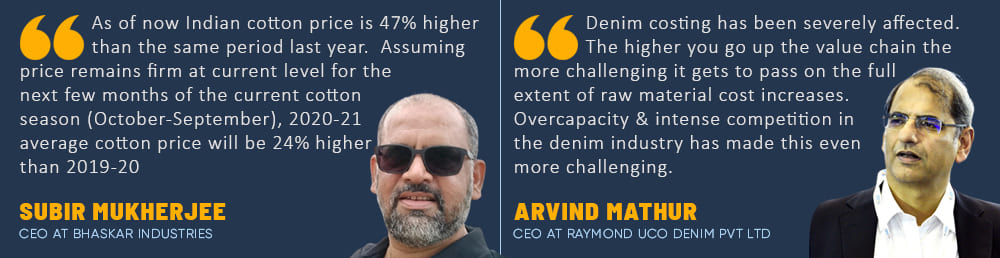

Subir Mukherjee, CEO Bhaskar denim says :

“As of now, Indian cotton price is 47% higher than the same period last year. Assuming price remains firm at the current level for the next few months of the current cotton season (October-September), 2020-21 average cotton price will be 24% higher than 2019-20″

Arvind Mathur CEO of Raymond’s denim also agrees and mentions the huge impact :

“Cotton prices have been very volatile in the last 1 year. Indian Denim grade cotton has seen prices rising by 40-45% in this period, higher than the increase in that of international cotton, despite subdued demand due to the pandemic. Smaller reported crop size, higher cotton & yarn exports, market interventions by Cotton Corporation of India are amongst the factors which had a large influence on the behavior of local prices.”

The increased prices of raw materials are not so easily acceptable by the buyers in a rising market especially when the whole business has been impacted by Covid. However, buyers are also aware of the whole situation, though they will always be trying to negotiate the best. Subir Mukherjee sounds positive on this front :

“Textile is low technology, low entry barrier hence, low margin business. Cotton contributes 30-45% of denim fabric cost. I believe this fact is well known to all buyers. While buyers and sellers are supposed to negotiate prices, it is never easy! I am sure no mill will be able to absorb such cotton prices without support from buyers. Buyers finally always pay a reasonable price under prevailing cost conditions. ”

Overcapacity and competition thrive in our industry. Even before covid, we had more capacity to produce than we could sell and there were umpteen mills coming up every year and existing ones expanding. This makes the competition fierce and there is undercutting. Arvind Mathur says :

“Denim costing has been severely affected. The higher you go up the value chain the more challenging it gets to pass on the full extent of raw material cost increases. Overcapacity & intense competition in the denim industry has made this even more challenging“

Currency

Another factor that goes against the Indian denim industry is the currency remaining relatively strong against the USD. Compared to Jan 2016 when 1 USD was about Rs 66, after 5 years it is now Rs 74 for a dollar. Though the depreciation looks good at 12%, it is much lower when compared to neighbor Pakistan. Pakistan’s currency in Jan 2016 was about PKR 104 and now it is about Rs 164 ie almost a 57% depreciation. Such a steep depreciation definitely helps the exporters of Pakistan to give more competitive prices. In the export market, Pakistan and China remain the biggest competitors for Indian denim fabrics.

Measures To Minimize The Impact Of Rising Cotton Prices

Even with this tough situation, there are always ways and means to mitigate the impact and each mill finds its own way to deal with it. Arvind Mathur suggests that the mills should try to focus on the following :

Cost reduction & productivity improvement

Offering value-added products & services

Optimizing product mix & re-engineering products where acceptable

Strategic withdrawal from unprofitable areas

The actual strategies to be adopted will also depend upon how each company is placed and what is their product profile Subir Mukherjee feels that things will turn around :

” If the complete apparel value chain could survive the 2011 cotton debacle, I am sure we will find a solution in the current situation too. The solution depends on mills closely working with buyers because there is no generic solution for all brands. Cotton cost increase affects a product based on cotton content and spinning technology used. However, the solution for an Rs999 retailed pair of jeans will be very different from an Rs2999 priced pair.”

“We would like to appeal to concerning government bodies and Textile Ministry to keep the interests of all players in the value chain in mind. Textile Industry is the 2nd largest employer in India and its reduced competitiveness can hurt employment generation and exports.” Says Mr. Arvind Mathur, CEO Raymonds Denim.

The Bottom Line

Substituting cotton with other fibers is one of the strategies being commonly used – mainly polyester for the local industry. However, even with other fibers including the recycled and lyocell ones, the prices are not getting any cheaper. In fact, they have increased at a significant pace as the race for sustainable products is pushing the brands to increase the quantum of such collections in their offerings. The choices are limited and the fight by the Indian denim mills continues. Only innovative solutions and adaptations will help the companies overcome these times.

“We keep hearing from brands globally that fabric prices must be cost neutral – “all product at last season price” is a mantra. I believe, even its preachers do not believe in it. You can’t shy away from product re-engineering. We are excited to get a lot of innovative product solutions keeping in mind the brand signature, which is certainly different for each brand. We are very closely working with some brands and finding amicable solutions. Challenging times trigger most innovations.” suggests Mr. Subir Mukherjee.