This is a report by Miguel Angel Andreu Marin from Cedetex- who has a long experience of the Mexican Textile Industry. He brings a macro analysis of the Mexican Textile Industry and its Outlook in a report recently published by him. We bring some key findings that he shares :

Key Findings

Mexico’s total GDP grew 0.25% in 2019. Flat behaviour.

- Textile GDP decreased 4%

- Clothes (Apparel) GDP decreased 4.7%

- The knitting sector grew 2%

- United States of America GDP grew 2.9% in 2019.

- 2020 first quarter fell 5%

- By the end of the year could be a fall of 5.9% of more.

- 2019 mexican inflation rate was 2.83%

- During the first five months of 2020 inflation rate continue being less and less, 2.15% in april

- Before the beginning of covid times, March 6th, the Exchange Rate begins to depreciate with respect to the United States Dollar, starting on $18 mexican pesos per U.S. Dollar, reaching a maximum of $ 25.12 on March 24th

- Starting in May, the exchange rate began to recover. Around $ 22 during the first fortnight of June.

- Despite the fact that the unemployment rate increased from 4.4% to 14.7% between March and April in the U.S.A. This country continues to be the main origin of money orders (remittances) to Mexico. The flow of this resource had a decrease of only 2.6% during the month of April compared to the same month of the previous year, with an amount of 2,861 million US dollars.

- Remittances increased 50% in March 2020 compared to the previous month, they were $ 4,694 million dollars.

- In April, they resumed the trend they have had in recent years, increasing 6.2% compared to February 2020

- The average wage of insured workers to the IMSS reached an amount of $ 403.6 (four hundred three point six pesos). More or less, USD $20 per day.

- The closure of Full Package suppliers in China and other Southeast Asian countries during the first quarter of 2020 led to additional orders for garments and footwear from Mexican factories.

- Total value of Imports of clothing from the World to the United States decreased 19% comparing January-April 2020 with the same period of the previous year, Mexico lost 25% . China had the biggest drop,

- Sales strategies that may be proposed in the near future by some big Mexican stores, as well as some the United States brands, could be delaying mark downs until the end of the season (Spring until August, Winter until March)

- Request their clothing suppliers, in different countries of the World, to acquire and use digital platforms for communications and collaborative design and production networks with their contractors

- Transform purchase orders, placed before the pandemic, into Fall-Winter collections

- Most textile and apparel factories in Mexico has been closed during the last three months. The fall of this industry GDP could be around 20% for the second quarter of 2020.

- With the “return to new normal”, the drop in GDP for the next three quarters would be less and less until it began to grow from the second quarter of 2021 on.

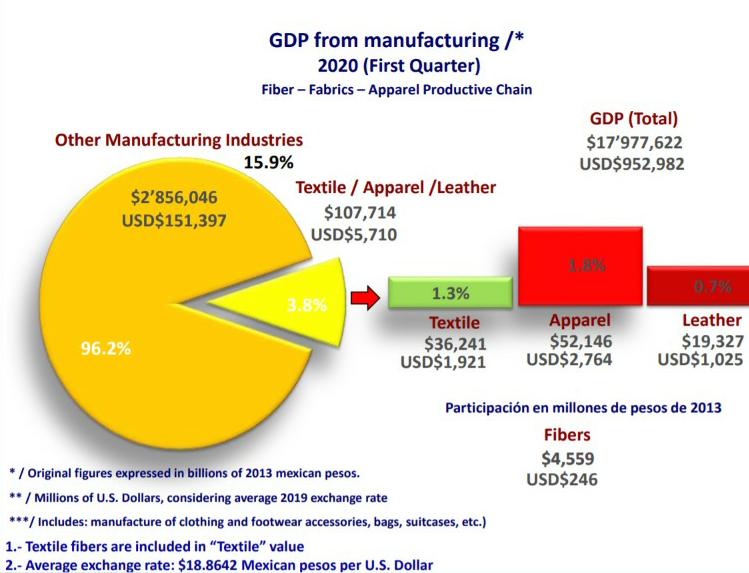

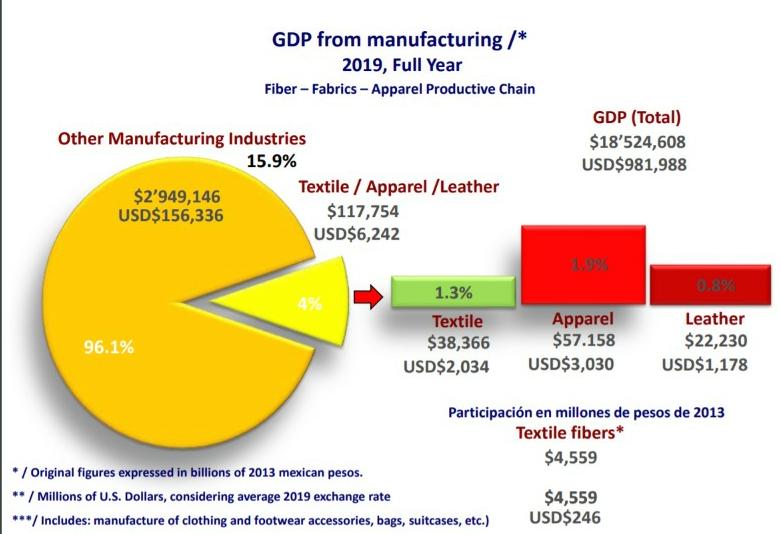

In the charts below, Miguel shares the contribution of the Mexican TExtile and Apparel industry to the Mexican GDP. It is interesting to note that only about 3.8% of the GDP comes from Textile and Apparel. And this % seems to have reduced in 2020 compared to 2019 .

In the table below, it is interesting to see the approx sales of different types of clothing in the country from 2016 to early 2020 . The sales figues of jeans, casual trousers, Dress Trousers , Blouses , and many other categories are given below. The relative share of different clothing is also given. Download link for the full report also given alongwith.

Rest of the report is visible to our paid subscribers. In case you wish to contact us for more info at , send email at mktg@balajiinternational.com . To see all protected reports titles,visit this page http://www.denimsandjeans.com/subscriber-only-reports-3