Leading Swedish retailer – H&M has recently released its Q4 financial result, according to which, the company has registered a net sales growth of 9% by the end of Q4 2019. In Q3 2018, the net sale was $5,614 million which rose to $6,194 million in Q4 2019. The total net sales by the end of Nov’19 stood at $24,131 million. The gross profit increased by 9% to $3,446 million, this corresponds to a gross margin of 54%.

On the Jan 30 earnings call, CEO Karl-Johan Persson said that

“The supply chain is a key area as well for our transformation, where the focus is on speed, flexibility, and efficiency to create an even better customer experience. And the work spans the entire product flow and — where logistics centers and logistic systems are important parts. We have, for example, opened a new high-tech logistic center in Milton Keynes in the U.K. that will replace several existing centers and serve both stores and online.”

Below are some of the insights and expansion plans according to the latest Press release of H&M:

-

Net sales in the period 1 December 2019 to 28 January 2020 increased by 5 percent in local currencies compared to the corresponding period the previous year.

-

Online and physical stores are being increasingly integrated with continued optimisation of the store portfolio. Around 200 new stores are planned to open in 2020, mainly in growth markets, while at the same time consolidation will continue with around 175 planned store closures, mainly in established markets. The net addition of new stores for full-year 2020 is expected to be around 25.

-

Australia is scheduled to become a new H&M online market in the second half of 2020.

-

H&M will be launched on the ecommerce platform SSG.COM in South Korea in 2020.

-

An agreement has been signed with a new franchise partner in Central America. The first H&M store is planned to open in Panama at the end of 2020.

-

The H&M group’s industry-leading sustainability work has been recognised in various ways; H&M was named by Corporate Knights as one of the World’s Most Sustainable Companies, while in the CDP (Carbon Disclosure Project) the H&M group is the first retail company to be included in the CDP A List.

Below are sales analysis covering the different periods. Please note that the official data were in SEK which we convert in USD. The base date for the conversion is – Feb 7, 2019

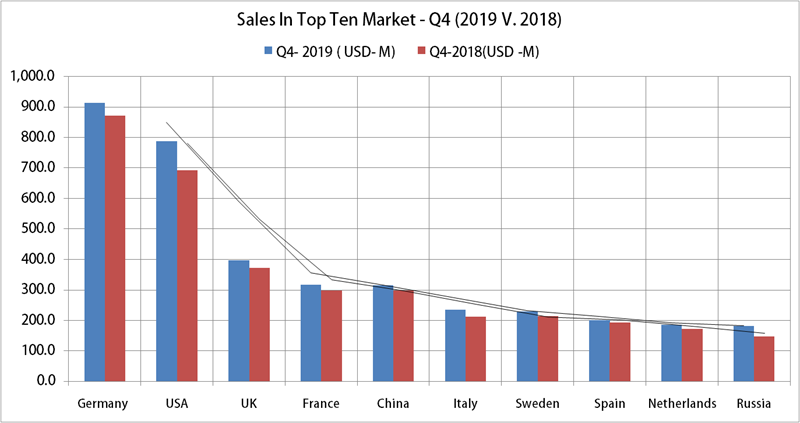

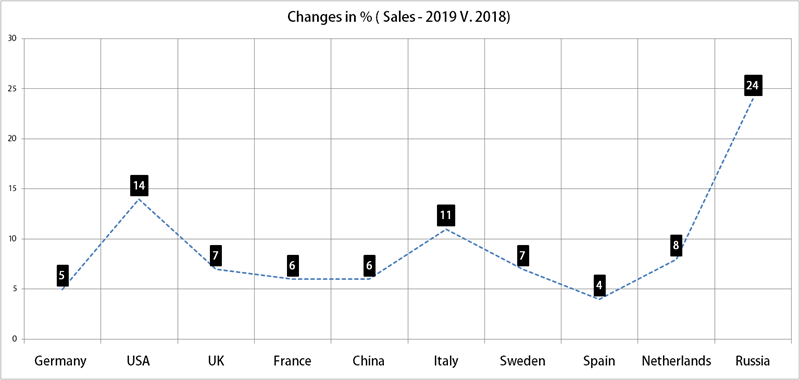

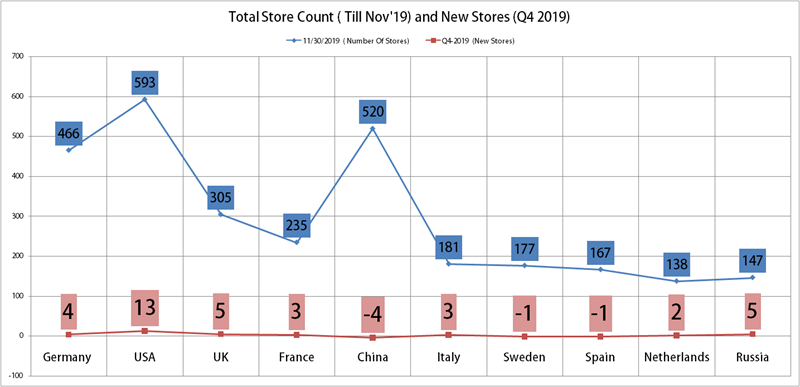

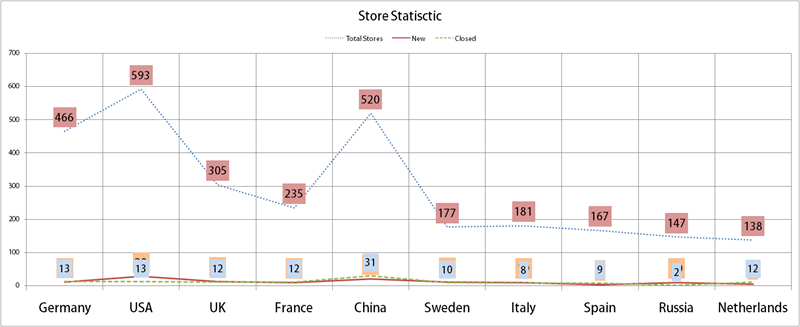

SALES IN TOP MARKET – Q4 2019 V. 2018

Germany, The USA, and the UK are three top-selling countries and collectively they contributed approx. 34% in the total sales in Q4 2019, Germany with $913.8 million is at Top. H&M has the highest number of stores i.e, 593 in the USA including 13 new stores which were in Q4 2019. The average sales/store in Q4 stood at $1.26 million/store however China fell short to this and registered a sale of $0.62 million/store only. China also saw the highest closure of stores i.e, 4 in Q4 2019. Russia witnessed an encouraging spike of 24% (highest amongst all) in the sales followed by the USA and Italy.

|

Country |

Q4- 2019 ( USD- M) |

Q4-2018(USD -M) |

Changes in % |

11/30/2019 ( Number Of Stores) |

Q4-2019 (New Stores) |

|

Germany |

913.8 |

871.3 |

5% |

466 |

4 |

|

USA |

787.6 |

692.3 |

14% |

593 |

13 |

|

UK |

396.3 |

371.4 |

7% |

305 |

5 |

|

France |

317.2 |

298.0 |

6% |

235 |

3 |

|

China |

315.3 |

298.2 |

6% |

520 |

-4 |

|

Italy |

235.3 |

211.9 |

11% |

181 |

3 |

|

Sweden |

228.8 |

213.1 |

7% |

177 |

-1 |

|

Spain |

200.6 |

193.3 |

4% |

167 |

-1 |

|

Netherlands |

185.1 |

171.2 |

8% |

138 |

2 |

|

Russia |

181.7 |

146.8 |

24% |

147 |

5 |

|

Others |

2,407.7 |

2,173.9 |

11% |

2147 |

75 |

|

Total |

6,169.4 |

5,641.4 |

9% |

5076 |

104 |

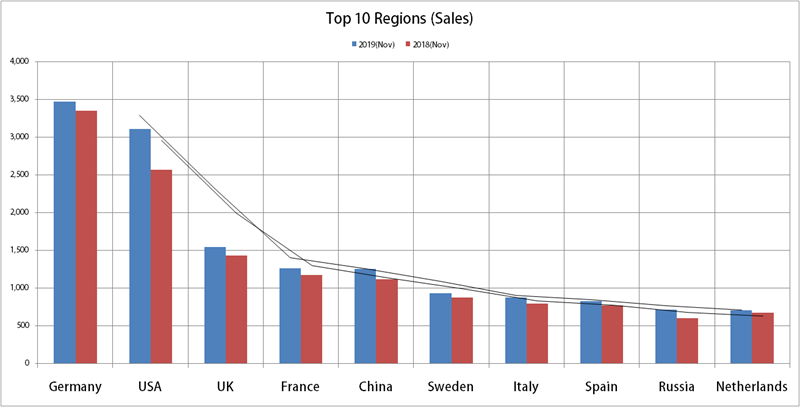

SALES IN TOP MARKET – Nov 2019 V. 2018

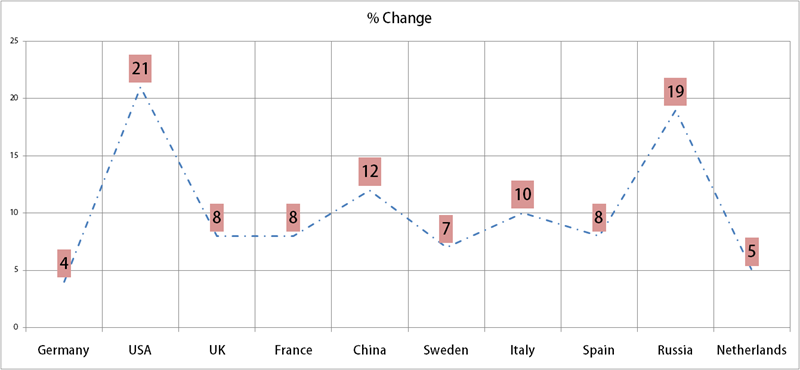

While looking at the comparative sales figure to Nov.19, we’ve learnt that Germany lost its sales contribution by approx 1% from the last year. By the end of Nov.2018, Germany’s share of the total net sales was 15.38% which slipped to 14.41% by the end of Nov 2019. A total of 281 new stores were opened and 173 stores were closed, out of which 31 stores closed in China alone. With 21% of Y-O-Y sales growth, the USA is at the top with $3,108 million of sales by the end of Nov 19, the previous year it was $2,571 million only. Total net sales during this period were $24,131 million which was 11% more than last year.

|

Region |

2019(Nov) |

2018(Nov) |

% Change |

Total Stores |

New |

Closed |

Share in 2019 |

Share in 2018 |

|

Germany |

3,477 |

3,356 |

4 |

466 |

11 |

13 |

14.41% |

15.38% |

|

USA |

3,108 |

2,571 |

21 |

593 |

28 |

13 |

12.88% |

11.79% |

|

UK |

1,544 |

1,427 |

8 |

305 |

13 |

12 |

6.40% |

6.54% |

|

France |

1,264 |

1,173 |

8 |

235 |

10 |

12 |

5.24% |

5.38% |

|

China |

1,250 |

1,114 |

12 |

520 |

21 |

31 |

5.18% |

5.11% |

|

Sweden |

932 |

871 |

7 |

177 |

12 |

10 |

3.86% |

3.99% |

|

Italy |

871 |

791 |

10 |

181 |

10 |

8 |

3.61% |

3.63% |

|

Spain |

822 |

764 |

8 |

167 |

4 |

9 |

3.41% |

3.50% |

|

Russia |

710 |

595 |

19 |

147 |

10 |

2 |

2.94% |

2.73% |

|

Netherlands |

706 |

670 |

5 |

138 |

6 |

12 |

2.93% |

3.07% |

|

Others |

9,445 |

8,482 |

11 |

2147 |

156 |

51 |

39.14% |

38.88% |

|

Total |

24,131 |

21,814 |

11 |

5076 |

281 |

173 |

100.00% |

100.00% |

TOP GROWING REGIONS

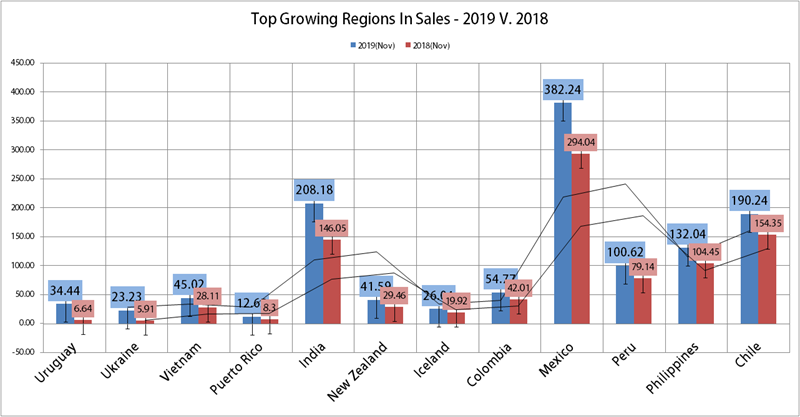

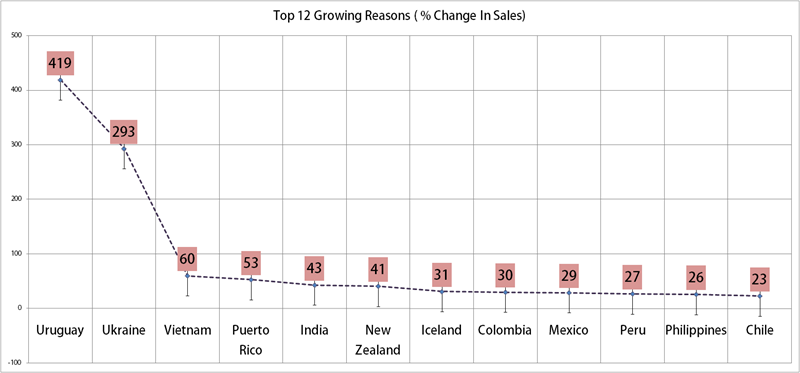

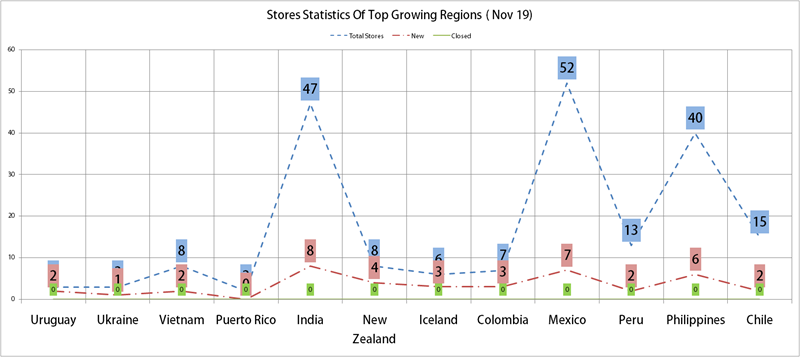

H&M has been aggressively expanding to different regions in the last couple of years. In Countries like India, the Philippines, and Mexico, H&M has invested a lot of resources and the results are unprecedented. Alone in India, within a couple of years, H&M opened 47 stores which generated $208 million sales, YOY sales growth by the end of Nov 2019 stood at 43%. Mexico with 52 stores is close to crossing the sales figure of $400 million, the growth was 29% by the end of Nov 19. New destinations including Ukraine and Vietnam have been outperforming and according to the various reports, H&M is going to expand its footprints more aggressively in the coming years.

|

Region |

2019(Nov) |

2018(Nov) |

% Change |

Total Stores |

New |

Closed |

|

Uruguay |

34.44 |

6.64 |

419% |

3 |

2 |

0 |

|

Ukraine |

23.23 |

5.91 |

293% |

3 |

1 |

0 |

|

Vietnam |

45.02 |

28.11 |

60% |

2 |

2 |

0 |

|

Puerto Rico |

12.65 |

8.3 |

53% |

8 |

0 |

0 |

|

India |

208.18 |

146.05 |

43% |

47 |

8 |

0 |

|

New Zealand |

41.59 |

29.46 |

41% |

8 |

4 |

0 |

|

Iceland |

26.04 |

19.92 |

31% |

6 |

3 |

0 |

|

Colombia |

54.77 |

42.01 |

30% |

7 |

3 |

0 |

|

Mexico |

382.24 |

294.04 |

29% |

52 |

7 |

0 |

|

Peru |

100.62 |

79.14 |

27% |

13 |

2 |

0 |

|

Philippines |

132.04 |

104.45 |

26% |

40 |

6 |

0 |

|

Chile |

190.24 |

154.35 |

23% |

15 |

2 |

0 |

|

Others |

20873.01 |

18887.86 |

11% |

4872 |

241 |

173 |

|

Total |

24143.07 |

21824.24 |

11% |

5076 |

281 |

173 |

With reasonable pricing and great supply chain distribution, H&M has been giving tough competition to its rival fast fashion brand Inditex. Zara, one of the leading labels from Inditex has not been able to grow this way as H&M has been growing in emerging developing countries. But it is not to say that H&M is not facing its own share of problems including excess stocks which it needs to dispose off. Time will tell !