PVH is one of the largest apparel companies worldwide. With an impressive collection of brands like CK, Tommy, Van Heusen etc. the company achieved a turnover of about $8.2 Billion in 2013. About 75% of of this turnover came from CK and Tommy(Growth brands) and balance came from the Heritage brands like Izod, Van Heusen etc.

The company does not disclose their sales of jeanswear separately, but it does give an indication that jeanswear is not one of their strongest segment and they need to provide much higher focus and attention to it.

We are giving below excerpts from the annual report from PVH which give some details on the financials, market distribution and growth directions for their global growth and heritage brands.

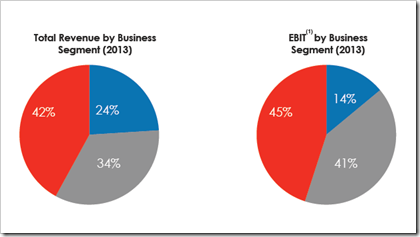

If we look at the pie charts below we will find that Calvin Klein & Tommy Hilfiger currently account for ~75% of PVH’s revenues and ~85% of PVH’s EBIT, where as heritage brands constitute the balance. We will then look at individual figures for Tommy, CK and Heritage brands.

Tommy, Calvin Klein, Heritage Brands

Tommy Hilfiger — Brand Overview

Tommy has over 1,450 Stores and over 10,000 Doors Globally in over 90 countries as of February, 2014

~out of these 625 are Company Operated Stores.Following is the breakup of number of stores worldwide for Tommy.

| Continent | No of Stores |

| Europe | 590 |

| Asia (excl. Japan) | 310 |

| North America | 230 |

| Rest of World | 180 |

| Japan | 155 |

Tommy Hilfiger — Business Overview & Financials

Tommy Hilfiger Europe – Overview

Europe accounts for ~50% of Tommy Hilfiger global reported revenues

Since 2000, revenues have grown at a 23% CAGR.

Tommy Hilfiger North America – Overview

North America accounts for ~45% of Tommy Hilfiger global reported revenues

• Strong retail presence of ~230 stores, which are primarily company stores.

Tommy Hilfiger Asia – Overview

Geographic expansion continues in Asia.Most regions experiencing double-digit growth.The sales in different regions in Asia is given below :

| Country | Sales |

| Japan | $175 MM |

| China | $135 MM |

| India | $90 MM |

| Southeast Asia and Australia | $270 MM |

Calvin Klein

Calvin Klein — has a strong global presence with significant growth opportunities. Europe has most stores followed by Asia.

| Continent | No of Stores |

| Europe | 850 |

| Asia | 735 |

| North America | 160 |

| Latin America | 90 |

Nearly 3,000 retail locations and over 20,000 wholesale doors globally as of February, 2014

Approximately 1,700 Company Operated Stores

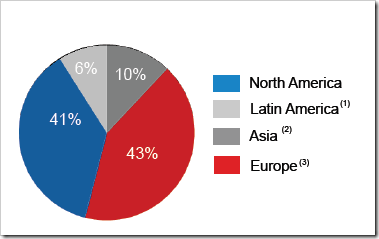

Calvin Klein — Business Overview And Financials

Calvin Klein — North America Overview

Calvin Klein North America revenues accounted for about 50% of Calvin Klein global reported revenues in 2013

The Company is not very happy about its Jeanswear business and says

“Jeanswear performance is challenging, but we are working to strengthen and rebuild the brand

through strategic investments in our product, people, infrastructure and in-store presentations”

Calvin Klein — Asia Overview

Asia accounted for about 20% of Calvin Klein global reported revenues in 2013

• Primarily retail-oriented model (concession shops and free-standing stores)

• High-teens operating margins for the region

− China: ~40% of Asia revenues; Experiencing solid sales growth

− Korea: ~30% of Asia revenues; Although still down vs. LY, the region is showing

improving trends over prior quarters

Calvin Klein — Latin America Overview

Latin America accounted for about 6%* of Calvin Klein global reported revenues in

2013, primarily driven by Brazil

Calvin Klein — Europe Overview

Europe accounted for about 20% of Calvin Klein global reported revenues in 2013

• Categories: Jeanswear and related products, underwear, accessories, bridge

apparel

• Business model: 50% retail / 50% wholesale

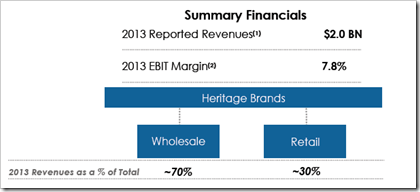

Heritage Brands — Overview & Financials

PVH has the following Heritage Brands – IZOD, ARROW, VANHEUSEN, SPEEDO and WARNER’S OLGA.

Review Of 1Q14 And FY2014 Guidance

The Group achieved a turnover of about $2 billion in the first quarter of 2014 (a 2% growth over 2013) and aims to achieve a turnover of about $8.5 Billion in 2014 with an estimated growth of 3%.

| Particular | 1Q14 | 1Q14 vs. 1Q13 %Growth | FY14 | FY14 vs. FY13 % Growth |

| Revenue | ~$2.0 BN | ~2% | ~$8.5 BN | ~3% |