Global Brands reported rises in revenue and profit, UNIQLO Japan reported declines in both revenue and profit, while UNIQLO International reported a rise in revenue but a fall in profit. Foreign exchange gains under other income/expenses and net finance income fell ¥18.9 billion compared to the first quarter of fiscal 2015, when the yen weakened significantly. As a result, consolidated profit before income taxes contracted by ¥29.0 billion to ¥77.6 billion.

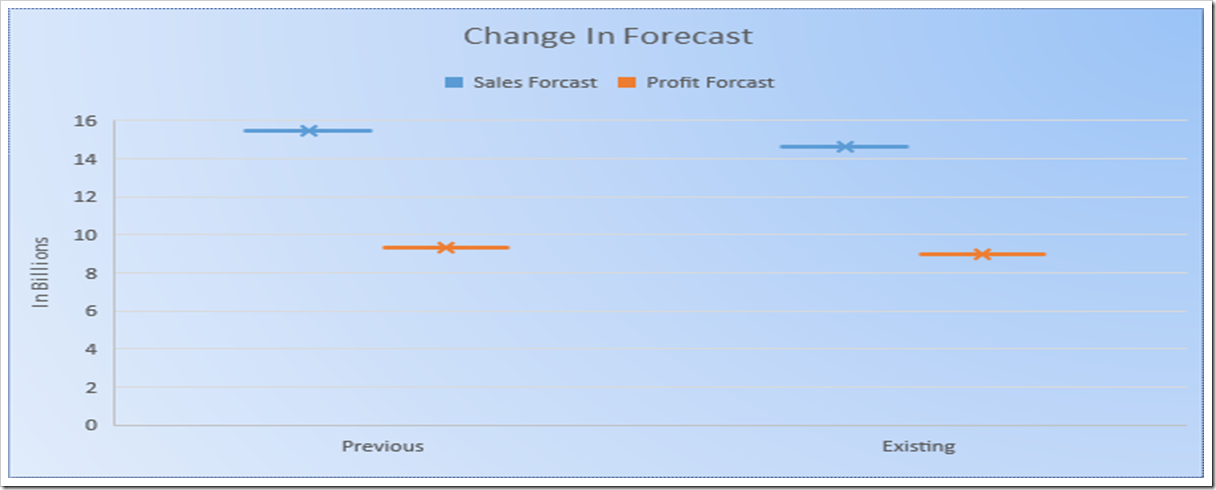

Consolidated revenue: ¥1.800 trillion (+7.0% year on year), operating profit: ¥180.0 billion (+9.4%), profit attributable to owners of the parent: ¥110.0 billion (-0.0%). Basic earnings per share: ¥1,079.01. These include downward revisions as follows: ¥100.0 billion for revenue, ¥20.0 billion for operating profit, and ¥5.0 billion for profit attributable to owners of the parent. Scheduled FY2016 annual dividend: ¥370 per share, unchanged.

These financial disappointments led the company to reconsider its product mix and hence, Fast Retailing plans to launch its spring collection earlier than expected and introduce less weather – sensitive products.

Uniqlo Japan also witnessed lower profits and sales in the quarter which has been hurt by “heavy discounting. Uniqlo’s international operations fell short of its targets with weak performances in Greater China and South Korea and the United States. Surprisingly, Uniqlo’s operations in Europe and Southeast Asia fared better.

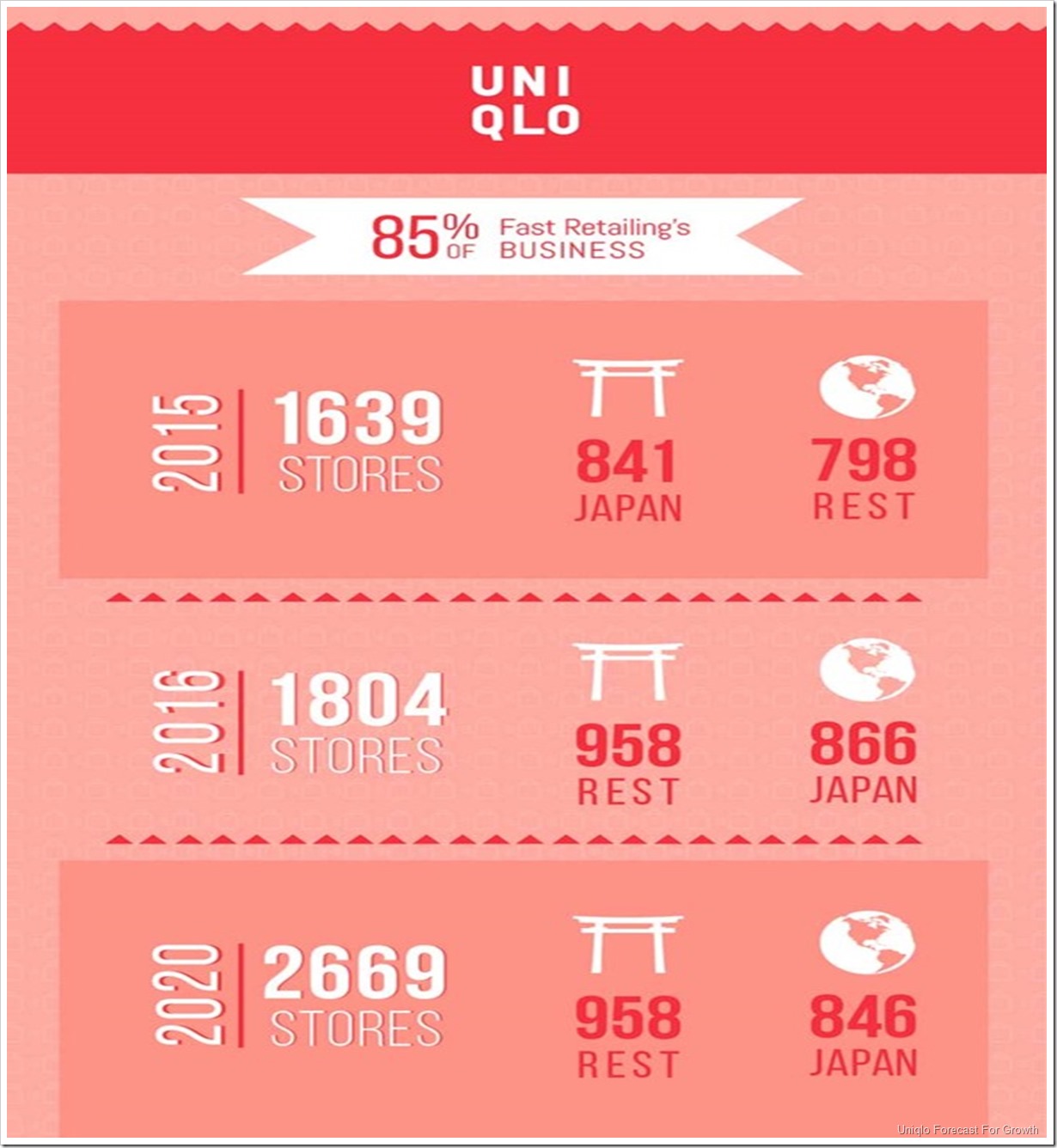

Unseasonal warm winter weather around the globe adversely impacted same-store sales at UNIQLO Greater China (Mainland China, Hong Kong and Taiwan), UNIQLO South Korea and UNIQLO USA in particular, resulting in a lower than expected performance and declining in profits in all three areas. Store network (End November 2015): 864 stores (+169 y/y). Fifteen years after the first UNIQLO store outside of Japan opened in London in fall 2001, UNIQLO International finally overtook UNIQLO Japan in terms of store numbers.

In fiscal 2016, Fast Retailing now expects to achieve consolidated revenue of ¥1.800 trillion (+7.0% year on year), operating profit of ¥180.0 billion (+9.4%) and profit attributable to owners of the parent of ¥110.0 billion (-0.0%). These data translate into basic earnings per share of ¥1,079.01. These figures have been revised down from our initial estimates announced in October 2015 as follows: ¥100.0 billion for revenue, ¥20.0 billion for operating profit and ¥5.0 billion for profit attributable to owners of the parent.

Fast Retailing Co., Ltd. is a public Japanese retail holding company. In addition to its primary subsidiary Uniqlo, it owns several other brands, including J Brand, Comptoir des Cotonniers, g.u., Princess Tam-Tam, and Theory. Denim is an integral part of Uniqlo’s apparel offer and of course J Brand is primarily a premium denim label.